Crypto's Big Options: Why This Changes Everything - Reddit Reacts

6|0 comments

Okay, folks, buckle up. We're staring down the barrel of a $16 billion crypto options expiry. Yes, that's billion with a "b." The headlines are screaming "volatility," "uncertainty," and probably a few mentions of the dreaded "crypto winter." But me? I'm seeing something else entirely: a massive pressure release valve, clearing the way for a *real* breakout.

Crypto Options Expiry: Unleashing the Market's Energy

Understanding the Crypto Options Expiry Let's break down what's happening. This week, a huge chunk of Bitcoin and Ethereum options contracts are expiring. Think of it like this: imagine a dam holding back a lake of potential energy. These options are the dam, and their expiry is like opening the floodgates. All that pent-up speculation, all those bets on which way the market will swing, are about to be unleashed.Data Speaks: Bitcoin Bulls Betting Big on $100K

Analyzing Market Sentiment and Data The data from Deribit, the crypto derivatives exchange, is fascinating. Bitcoin's "max pain point"—the price where the most option holders will lose money—is sitting way up at $100,000, while Bitcoin itself is hovering around $91,000. This suggests a strong bullish sentiment underlying the market. People aren't just hoping for a rally; they're actively betting on it. The put-to-call ratio of 0.54 confirms this, showing more traders are expecting gains than losses.Smart Money's Bitcoin Strategy: Buckle Up, But Stay Bullish

The Role of Smart Money and Options Strategies But here's where it gets interesting. Analysts at Fleet Asset Management Group (FLAMGP) noted that even with Bitcoin's recent dip, demand for protective positions has *increased*. What does this mean? It means smart money is playing both sides of the field, preparing for anything while still leaning bullish. It's like a race car driver who knows when to brake hard before accelerating out of a turn.Santa Rally Incoming? Big Money Bets on Year-End Surge

Betting on a Year-End Rally And here's my favorite part: the emergence of a massive "call condor." This is an options strategy designed to profit from upside movement within a specific range, in this case targeting $100,000+ by the end of December. Someone out there is betting big on a "Santa rally," and they're not alone. As the Deribit analysts pointed out, this aggressive end-of-year positioning reveals that even after the recent correction, a significant portion of traders is confident in a strong rebound. Bitcoin & Ethereum Brace for $15 Billion November Options ExpiryCrypto's Dot-Com Moment: The Future is Unwritten

The Bigger Picture: Crypto's Long-Term Potential This isn’t just about numbers; it’s about psychology. It's about the collective belief in the long-term potential of crypto, even when faced with short-term turbulence. It reminds me of the early days of the internet. Remember all the dot-com crashes? People declared the internet dead, a fad. But the underlying technology was revolutionary, and it ultimately transformed the world. I see the same potential with crypto.DeFi's Dawn: Taking Back Control of Our Financial Future

The Promise of Decentralized Finance What does all this mean for you? Imagine a future where decentralized finance is the norm, where you have complete control over your assets, where financial transactions are seamless and transparent. That's the promise of crypto, and it's why I'm so excited about its future.Guiding Crypto's Ascent: Responsible Growth is Key

Navigating Risks and Ensuring Responsible Growth Of course, there are risks. The FLAMGP report highlights the importance of risk management in this volatile environment. Their AI-based risk monitoring system, FAMG 3.0, is a testament to the growing sophistication of the crypto market. We need responsible actors, transparent regulations, and robust security measures to ensure that crypto fulfills its potential without causing harm. But I believe we're on the right track.Crypto Confidence: From Winter to Spring Awakening

Growing Adoption and Public Confidence And, with adoption growing rapidly, two out of three Americans being familiar with crypto, and 28% already owning it, rising from just 15% in 2021, we can see that public confidence is growing after the "crypto winter" of 2022. 2025 Cryptocurrency Adoption and Consumer Sentiment Reporthtml Crypto's Dawn: A New Era of Decentralized Innovation?

Crypto's Next Chapter is About to Begin

-

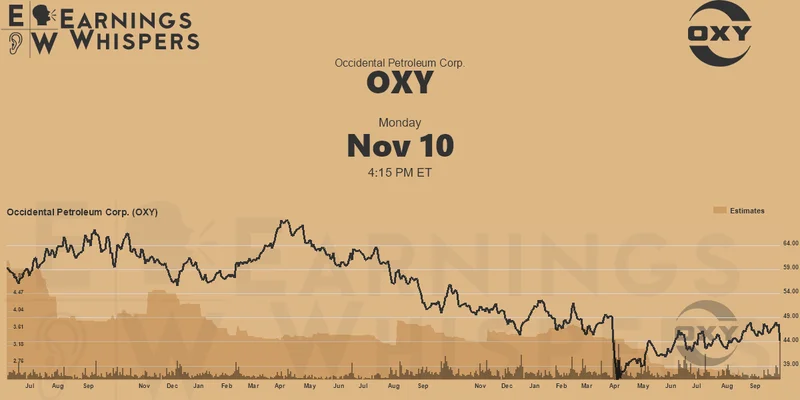

Warren Buffett's OXY Stock Play: The Latest Drama, Buffett's Angle, and Why You Shouldn't Believe the Hype

Solet'sgetthisstraight.Occide...

-

The Great Up-Leveling: What's Happening Now and How We Step Up

Haveyoueverfeltlikeyou'redri...

-

The Future of Auto Parts: How to Find Any Part Instantly and What Comes Next

Walkintoany`autoparts`store—a...

-

Applied Digital (APLD) Stock: Analyzing the Surge, Analyst Targets, and Its Real Valuation

AppliedDigital'sParabolicRise:...

-

Analyzing Robinhood: What the New Gold Card Means for its 2025 Stock Price

Robinhood's$123BillionBet:IsT...

- Search

- Recently Published

-

- Cryptocurrency Market: Current Outlook: Price Predictions vs. Market Reality

- Web3 Hype: What the Data Really Says - Hot Takes Only

- Crypto's Big Options: Why This Changes Everything - Reddit Reacts

- DeFi Crash? Why 2025 Unlocks Staggering New Opportunities. - (Crypto Twitter Reacts)

- Why $15B Options Are Bitcoin's True Test - Crypto Twitter Reacts

- Uber Ride Demand: Cost Analysis vs. Thanksgiving Deals

- Stock Market Rollercoaster: AI Fears vs. Rate Hike Panic

- Bitcoin: The Price, The Spin, & My Take

- Asia: Its Regions, Countries, & Why Your Mental Map is Wrong

- Retirement Age: A Paradigm Shift for Your Future

- Tag list

-

- Blockchain (11)

- Decentralization (5)

- Smart Contracts (4)

- Cryptocurrency (26)

- DeFi (5)

- Bitcoin (31)

- Trump (5)

- Ethereum (8)

- Pudgy Penguins (6)

- NFT (5)

- Solana (5)

- cryptocurrency (6)

- bitcoin (7)

- Plasma (5)

- Zcash (12)

- Aster (10)

- nbis stock (5)

- iren stock (5)

- crypto (7)

- ZKsync (5)

- irs stimulus checks 2025 (6)

- pi (6)

- hims stock (4)

- kimberly clark (5)

- uae (5)